FOR INTERMEDIARIES

The Only Intermediary

Platform Built for Growth

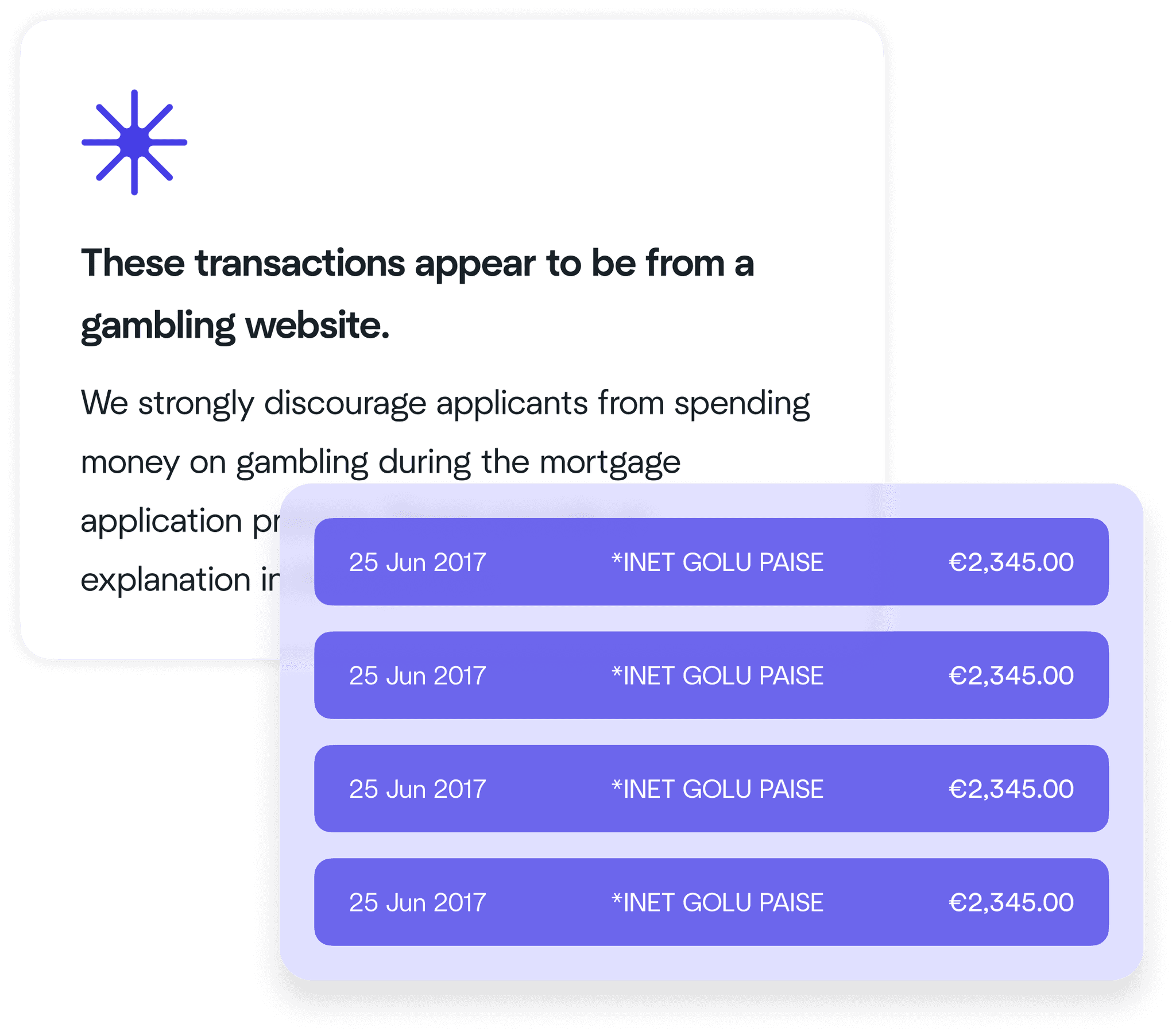

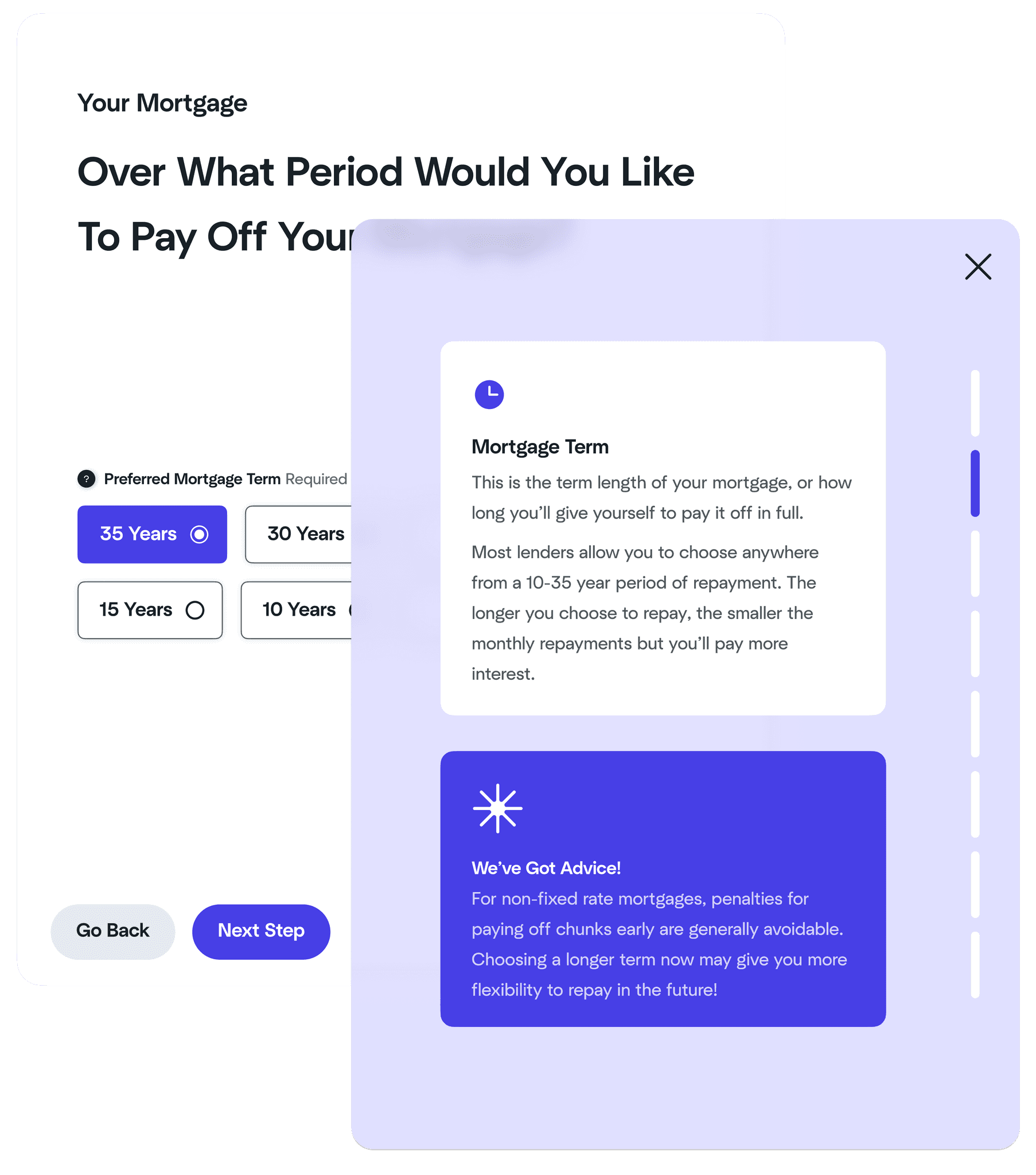

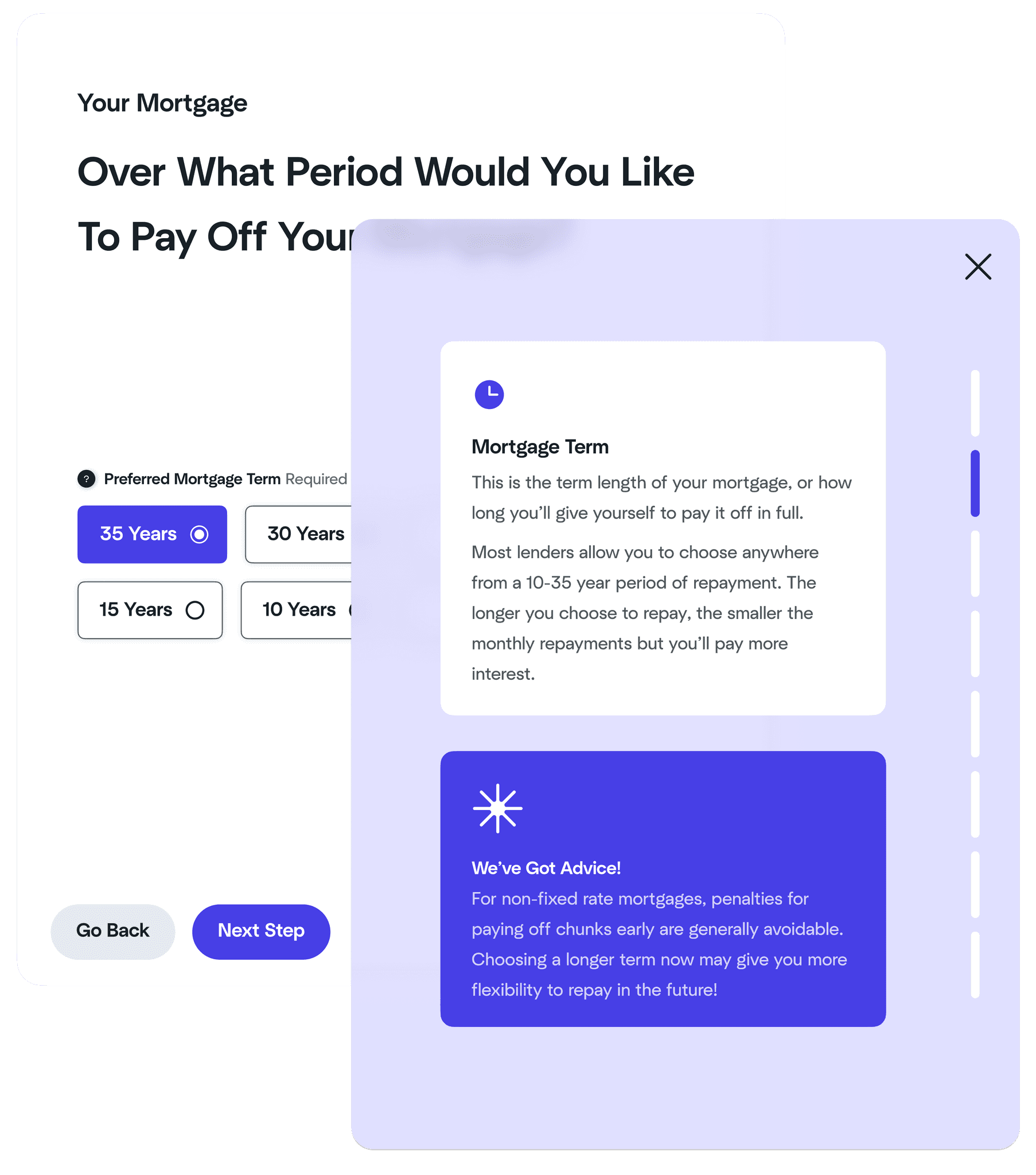

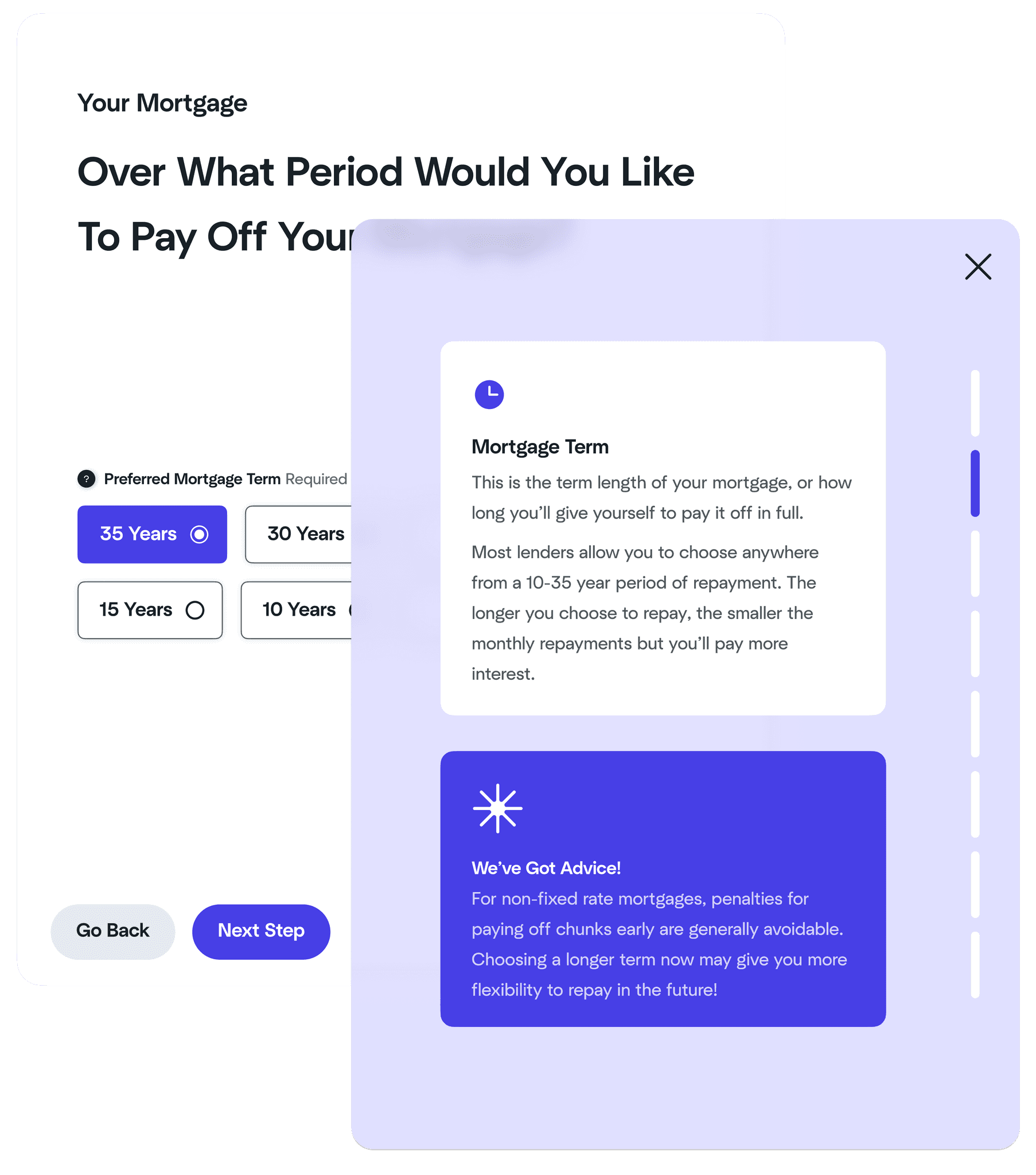

Mortgage applications will never be the same again. Simple for your clients to complete with contextual help built right in. A dream for you with in-app communication and timely notifications and progress reports.

FOR INTERMEDIARIES

The Only Intermediary Platform Built for Growth

Mortgage applications will never be the same again. Simple for your clients to complete with contextual help built right in. A dream for you with in-app communication and timely notifications and progress reports.

FOR INTERMEDIARIES

The Only Intermediary

Platform Built for Growth

Mortgage applications will never be the same again. Simple for your clients to complete with contextual help built right in. A dream for you with in-app communication and timely notifications and progress reports.

80%

Reduction in time and effort to process and submit a mortgage application

80%

Reduction in time and effort to process and submit a mortgage application

80%

Reduction in time and effort to process and submit a mortgage application

8x

Faster than processing mortgage applications manually

8x

Faster than processing mortgage applications manually

8x

Faster than processing mortgage applications manually

97%+

Model accuracy in independent testing. When we're not sure, we let you know

97%+

Model accuracy in independent testing. When we're not sure, we let you know

97%+

Model accuracy in independent testing. When we're not sure, we let you know

You Keep The Economy Moving. We Add Efficiency.

You Keep The Economy Moving. We Add Efficiency.

The mortgage process should be frictionless. That's the founding belief that led us to design and build the LendWell platform. We automate the process in ways that assist you and your clients —ensuring that the personal connection that you always bring is never lost along the way.

You Keep The Economy Moving.

We Add Efficiency.

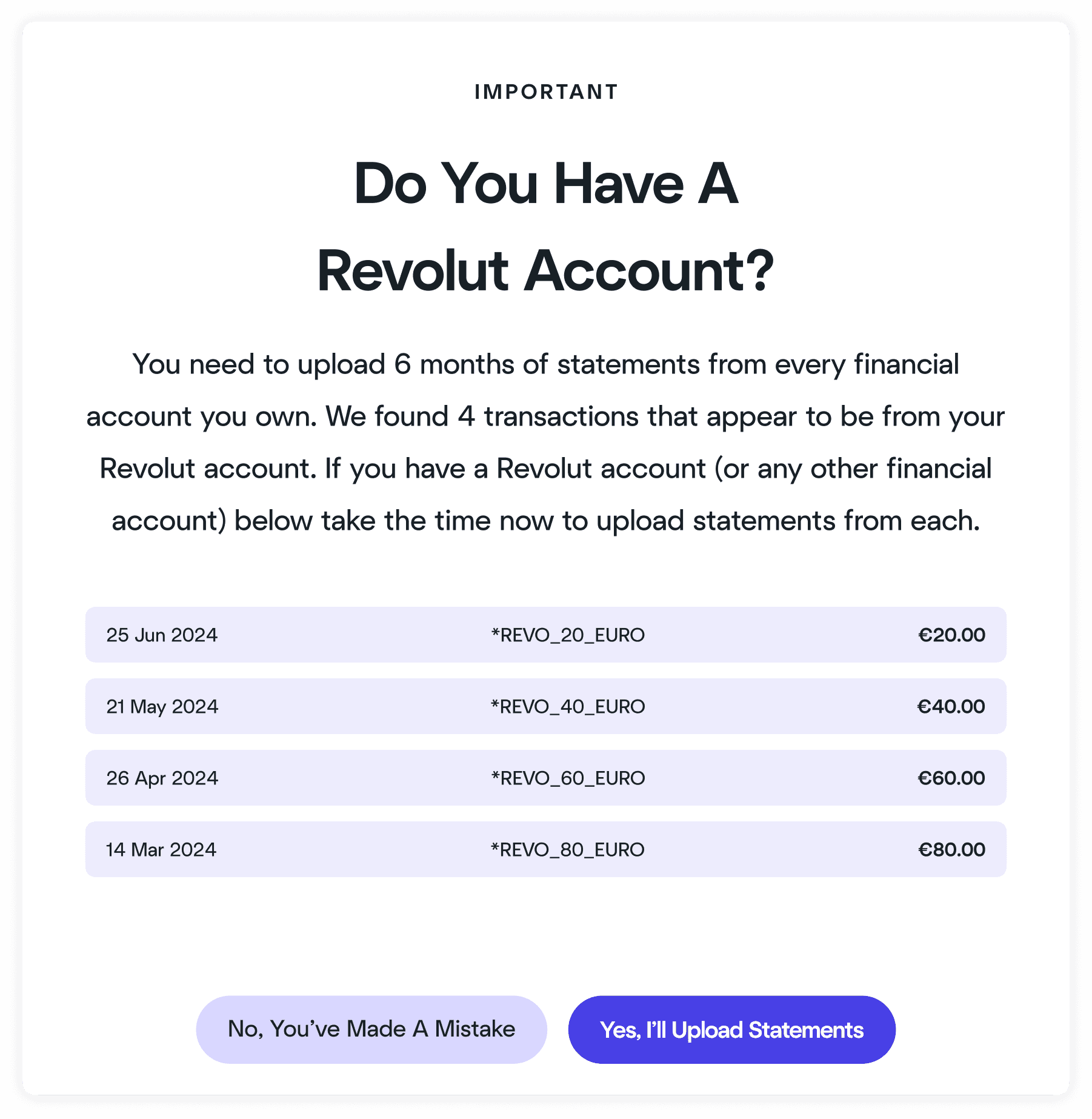

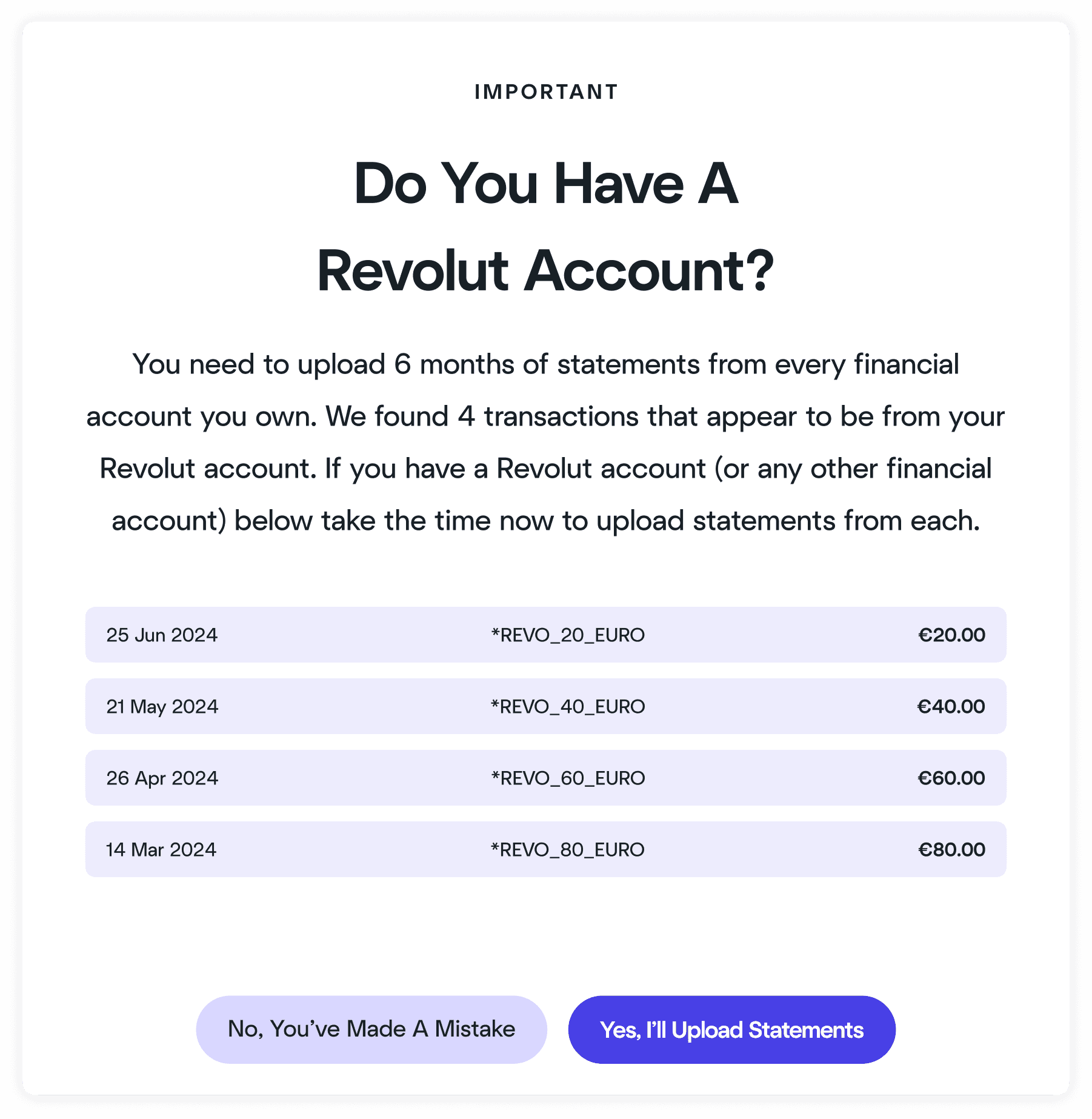

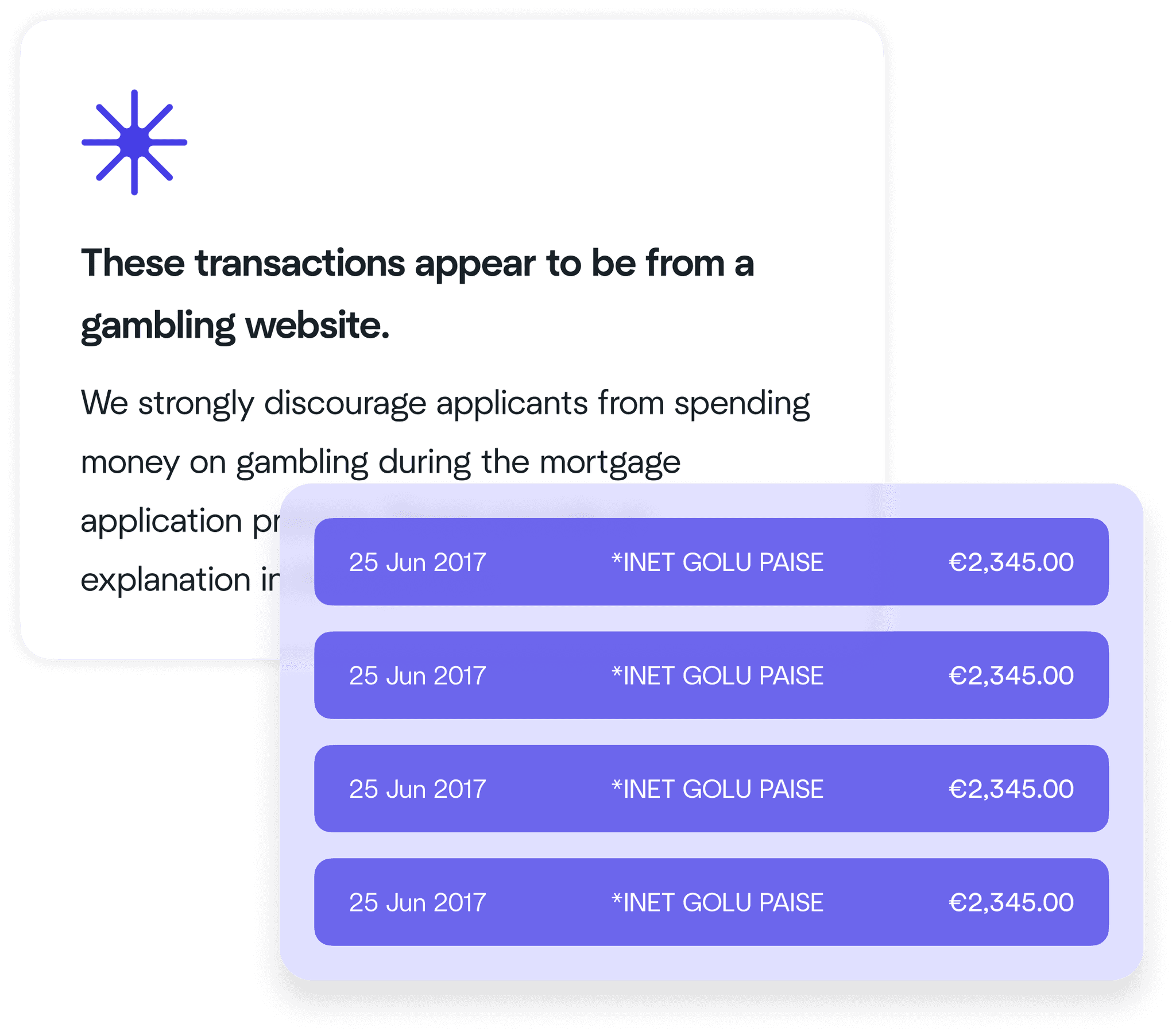

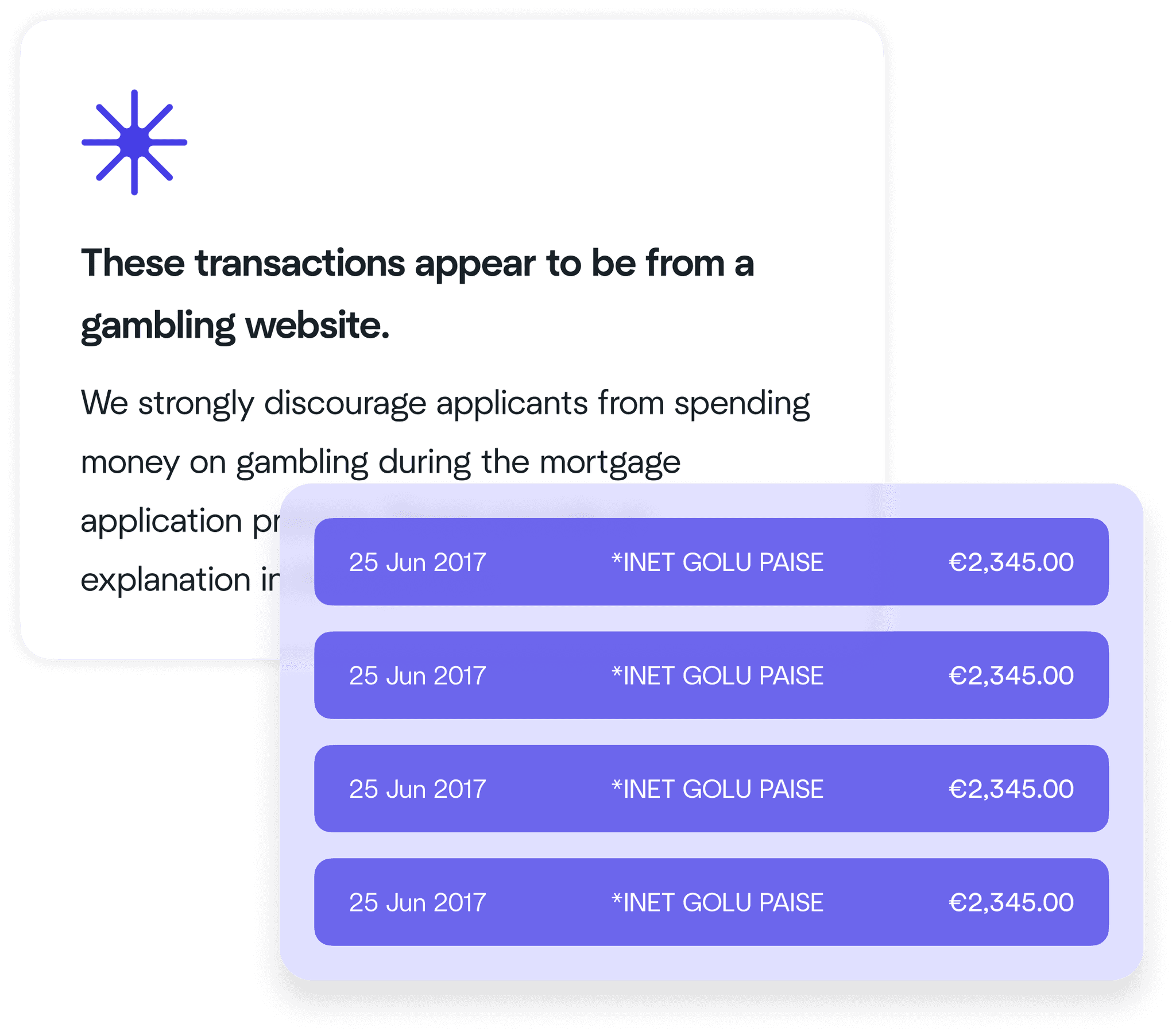

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

You Don't Need To Be A Tech Company To Offer Cutting-Edge Technology.

You Don't Need To Be A Tech Company To Offer Cutting-Edge Technology.

Our platform provides you with state-of-the-art tools and effortless integration, so you can deliver top-tier solutions and stay competitive, without being a tech expert. NEW

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

You Don't Need To Be A Tech Company To Offer Cutting-Edge Technology.

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

Grow Your Margins. Not Your Payroll.

Grow Your Margins. Not Your Payroll.

LendWell is designed to drive revenue growth and operational excellence, so you can increase your margins and succeed financially without adding to your payroll burden.

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

Grow Your Margins.

Not Your Payroll.

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

Consistent Workloads. Better Returns.

Consistent Workloads. Better Returns.

Stabilise your workload, we enable you to focus on delivering quality and maximising returns, leading to a more predictable and profitable business outcome.

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

Consistent Workloads.

Better Returns.

LendWell digitises bank statements, pay stubs, salary certificates, and more. Better yet, LendWell ensures all documents are up-to-date, complete, and consistent with the application details, making your mortgage processing smarter and faster.

Getting started with LendWell is seamless and simple. Our expert advisors are on-hand to help answer your questions.

1. How do I get started with LendWell?

2. How does LendWell handle migration from existing platforms?

3. What onboarding and training does LendWell provide?

4. How does LendWell charge for its services?

5. Do I need to use all LendWell products?

FAQs

Getting started with LendWell is seamless and simple. Our expert advisors are on-hand to help answer your questions.

1. How do I get started with LendWell?

2. How does LendWell handle migration from existing platforms?

3. What onboarding and training does LendWell provide?

4. How does LendWell charge for its services?

5. Do I need to use all LendWell products?

FAQs

Getting started with LendWell is seamless and simple. Our expert advisors are on-hand to help answer your questions.

1. How do I get started with LendWell?

2. How does LendWell handle migration from existing platforms?

3. What onboarding and training does LendWell provide?

4. How does LendWell charge for its services?

5. Do I need to use all LendWell products?

PRODUCTS

USE CASES

PRODUCTS

USE CASES