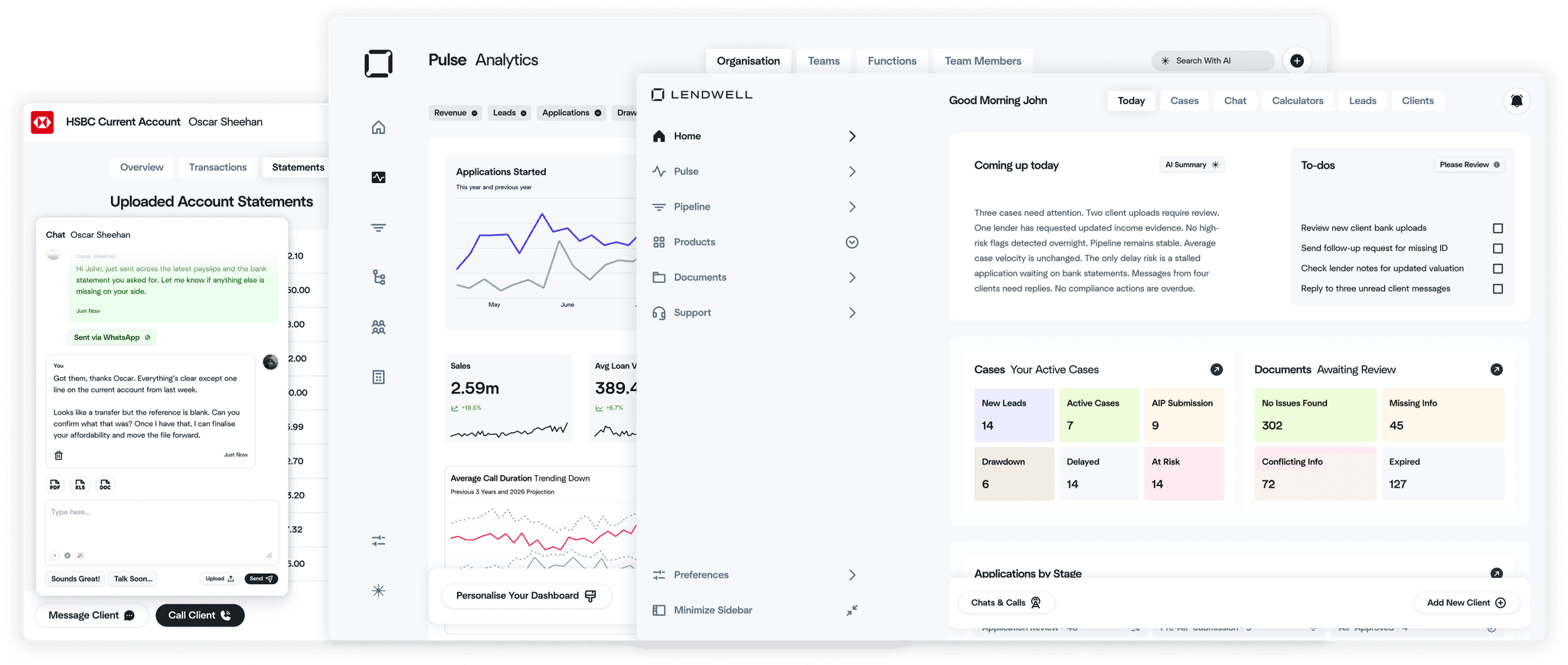

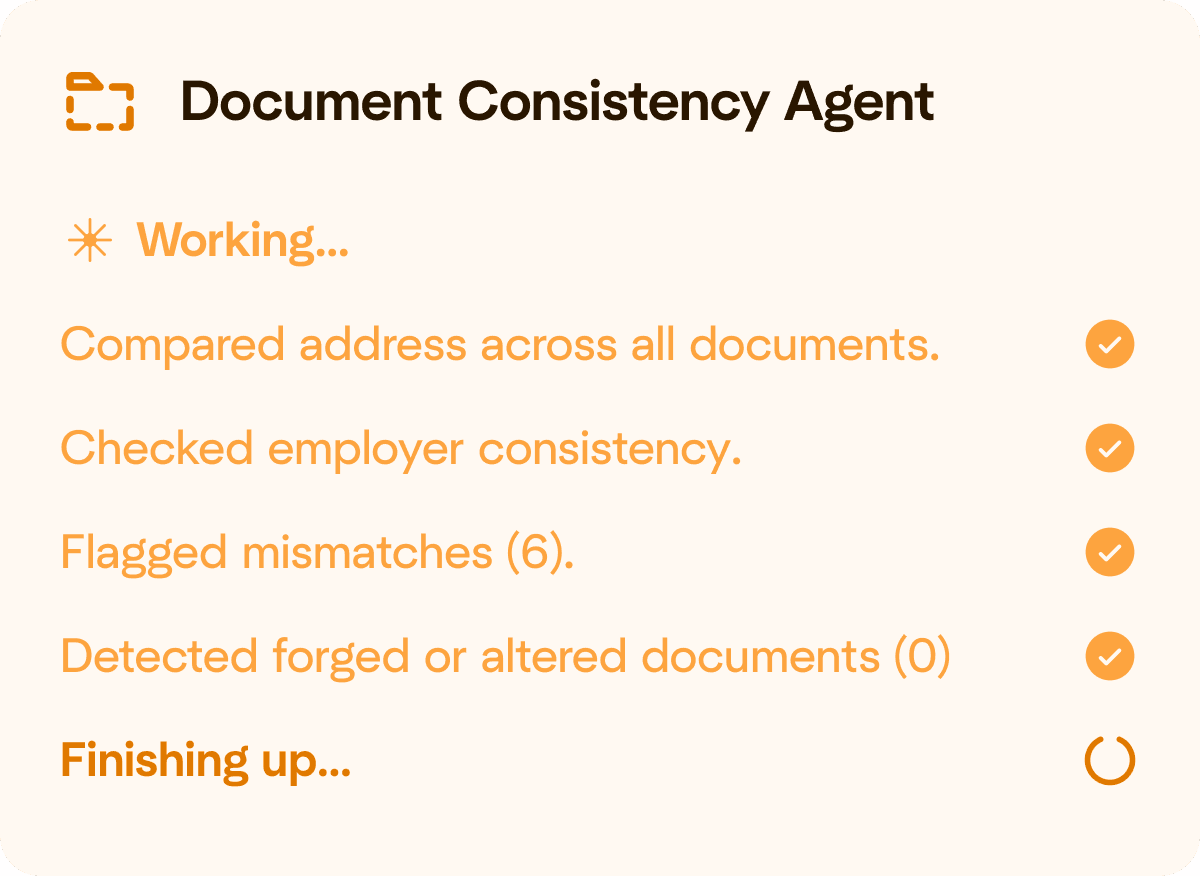

With LendWell, you have instant access to the answers and data you need at your fingertips. Our intuitive system and clever data structure allow you to find information faster than you can type, ensuring you get the answers you need without delay.

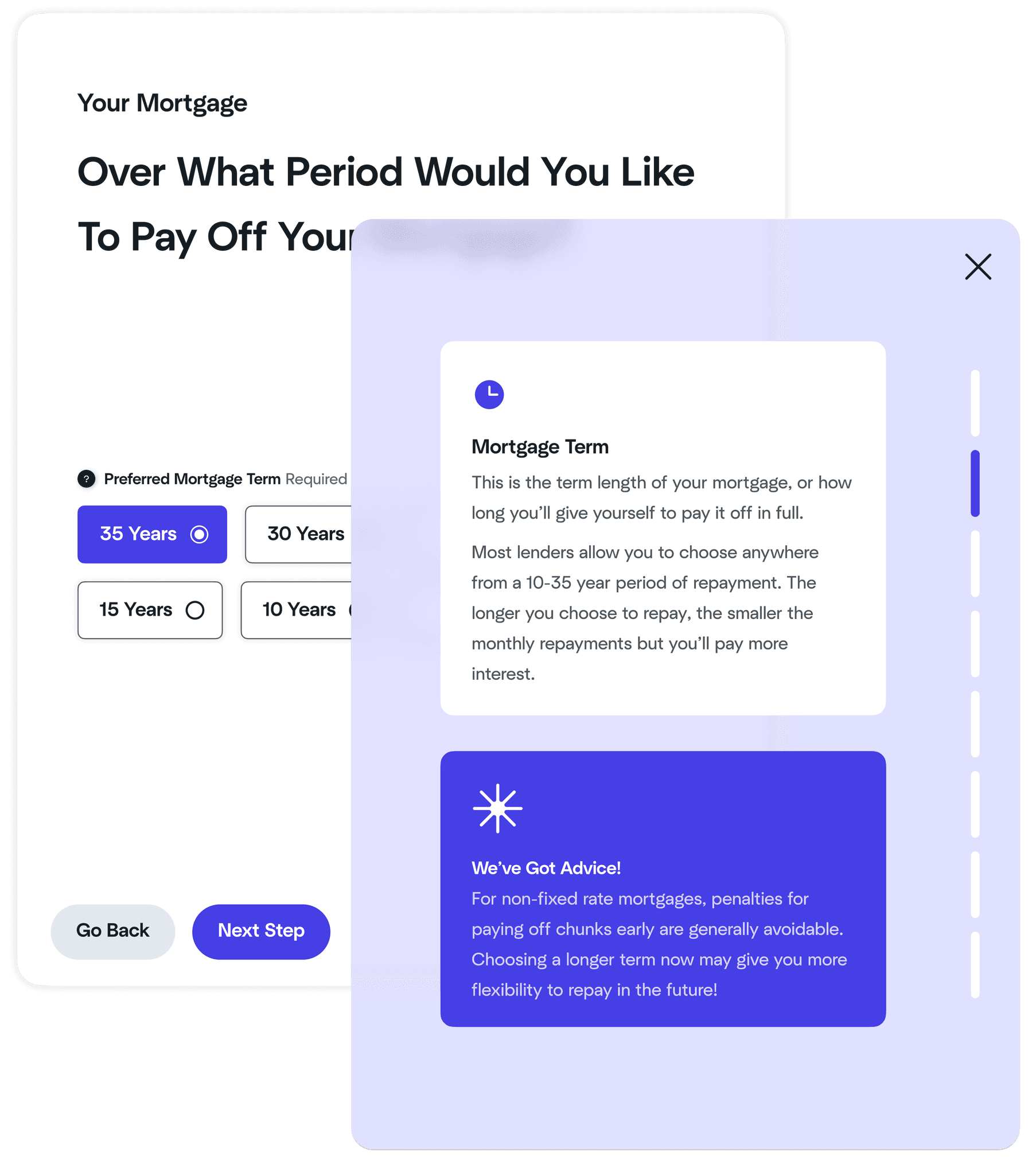

Instant, intelligent support with precise responses, keeping clients informed and reducing advisor's workload.

Our scalable infrastructure supports your business growth, allowing you to expand quickly without increasing headcount.

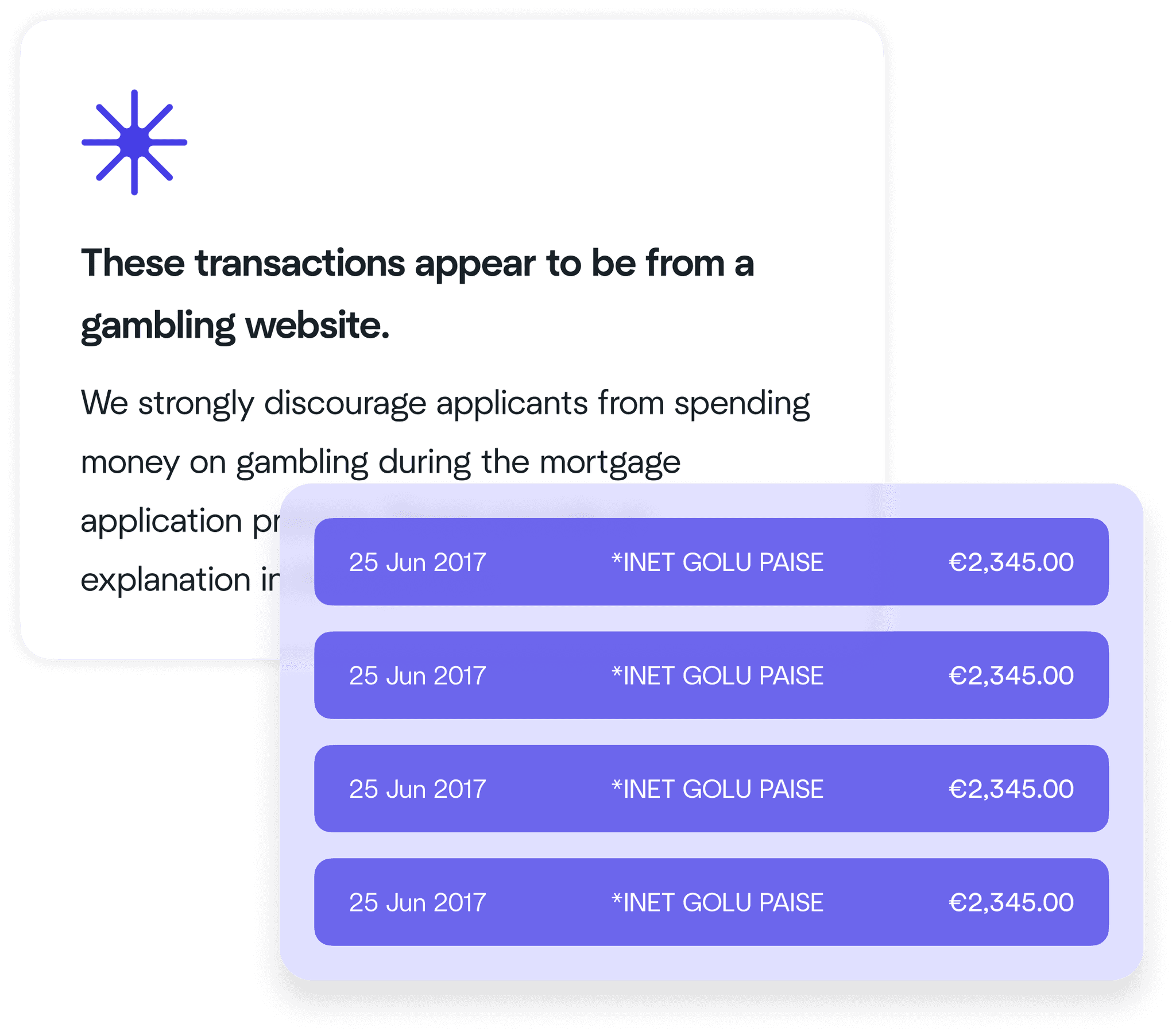

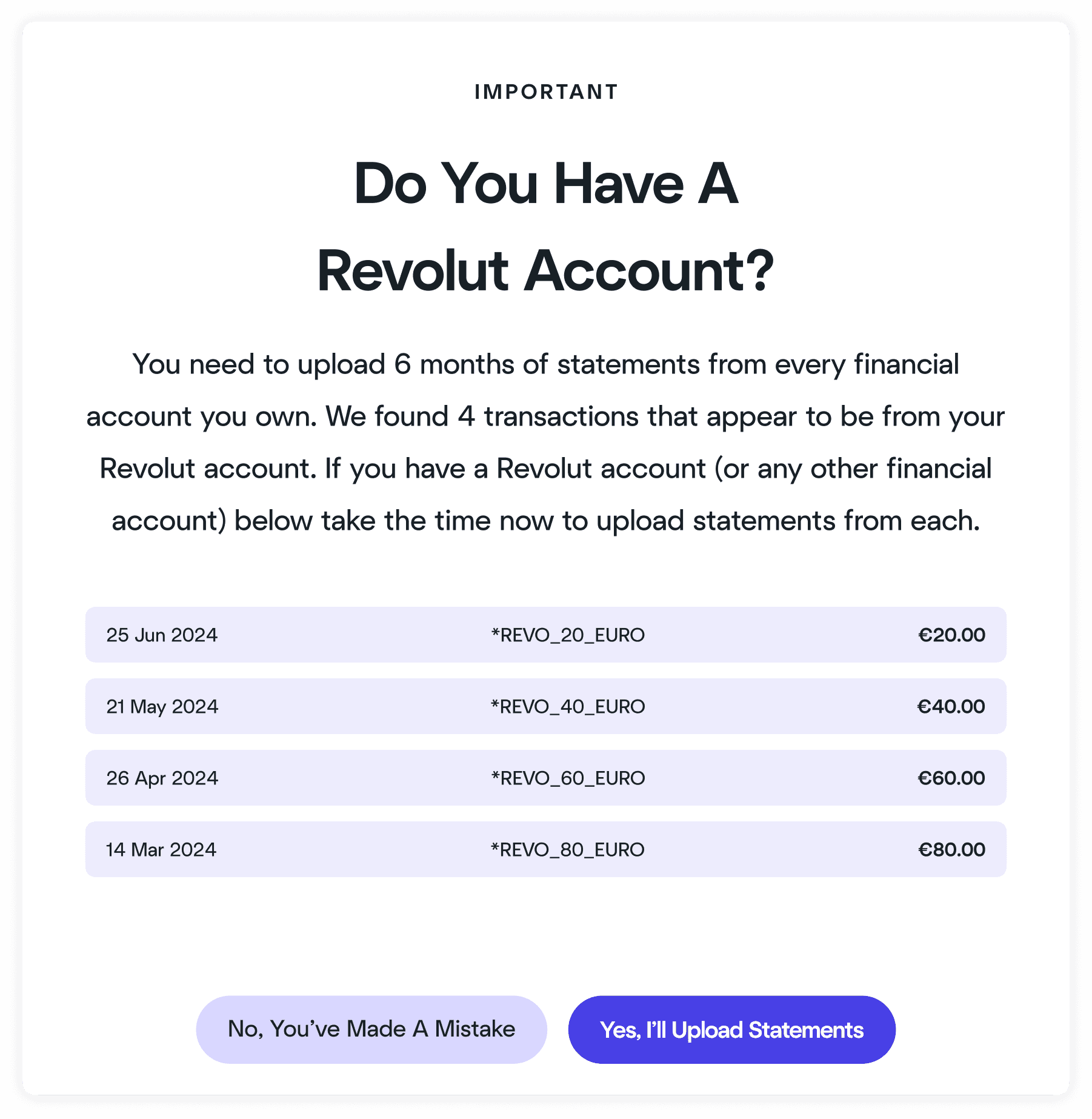

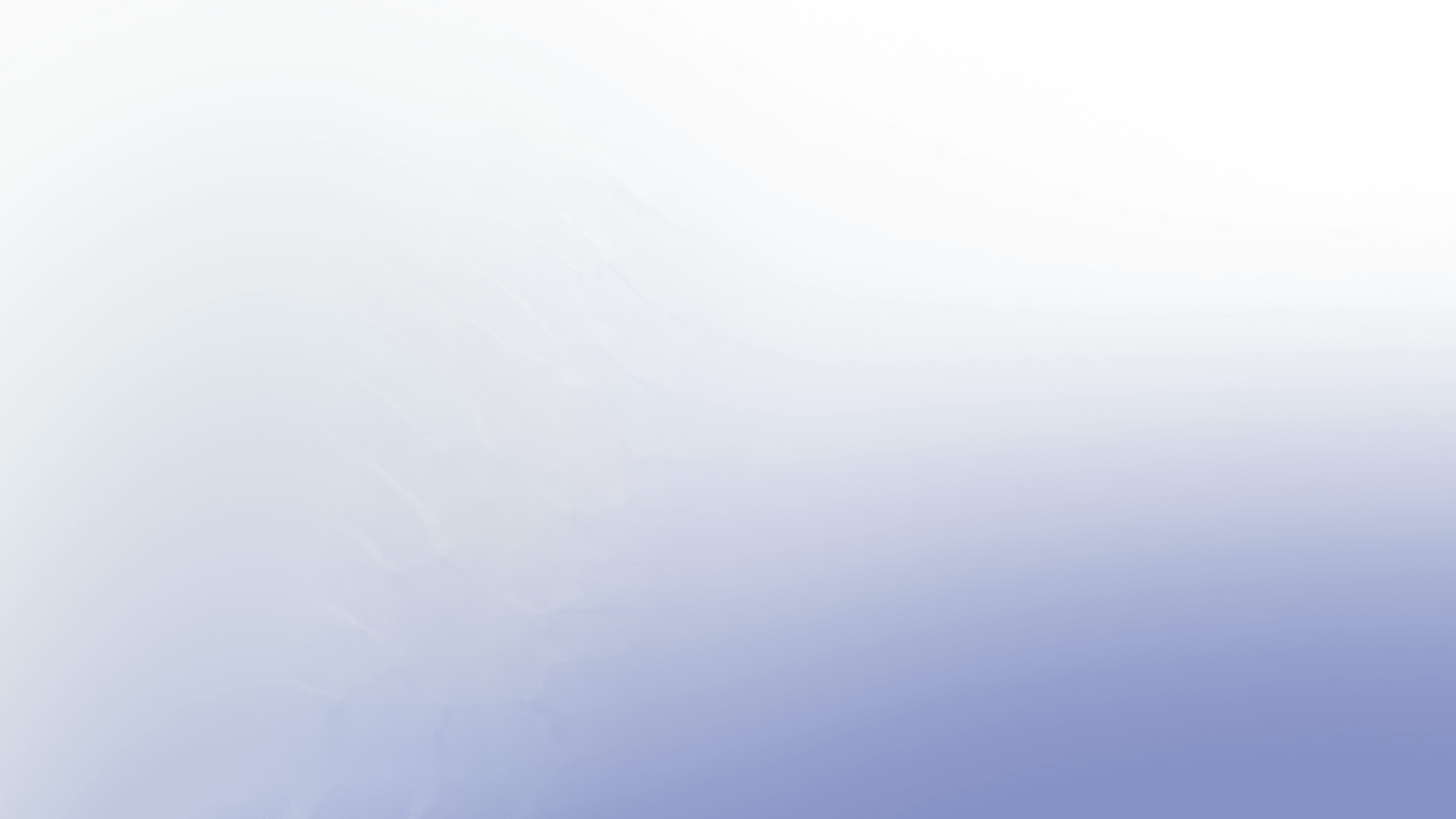

Financial readiness in seconds. Know you are talking to customers who are mortgage ready today, not in 6 months. Let your competition waste time chasing documents whilst you get real-time access to their financial accounts.

LendWell uses advanced encryption protocols, including AES-256 and TLS, along with robust security measures to ensure your customers' data is protected and compliant at all times.

We enable brokers to offer a uniform and frictionless mortgage experience that simplifies client interactions and accelerates approvals.

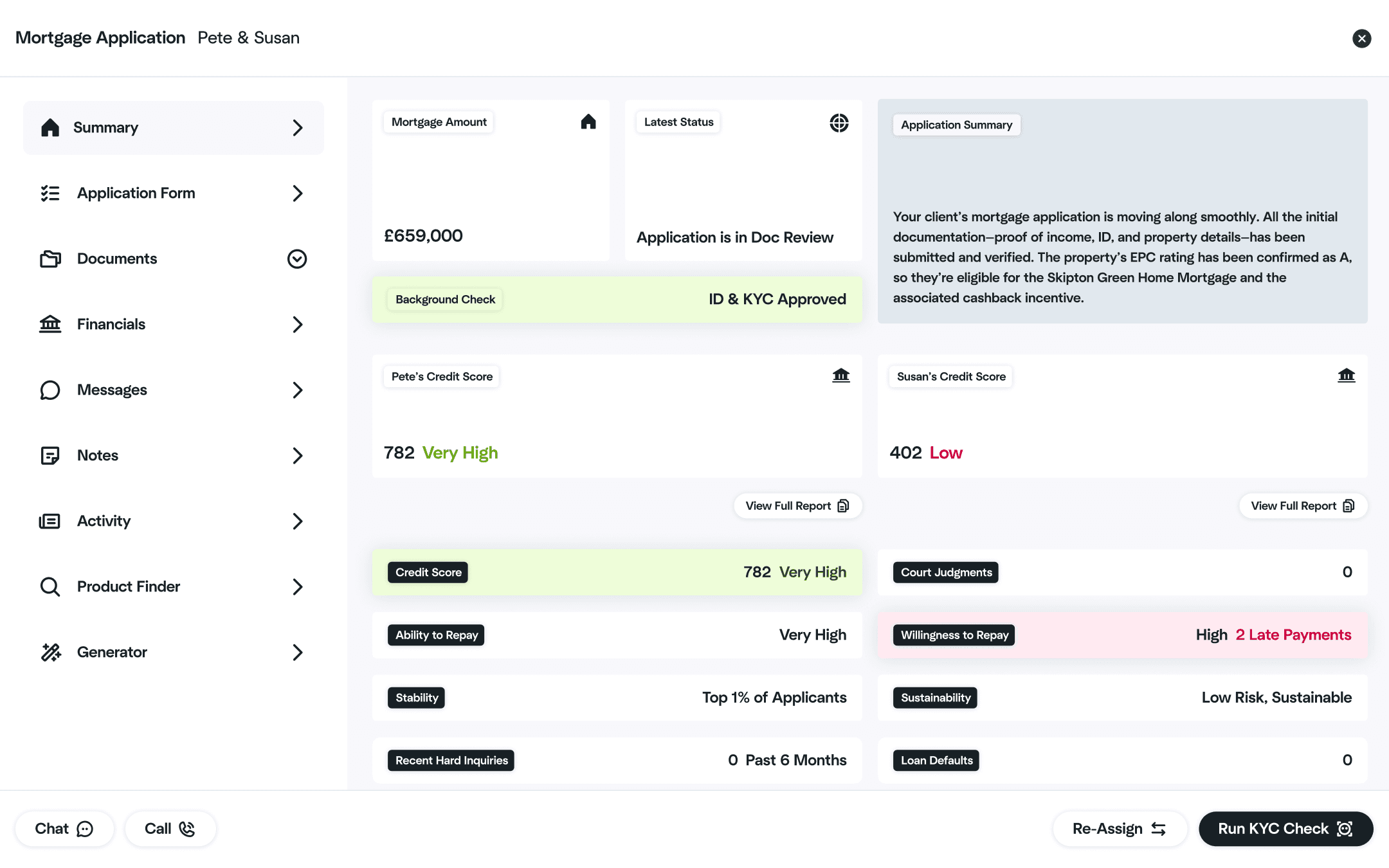

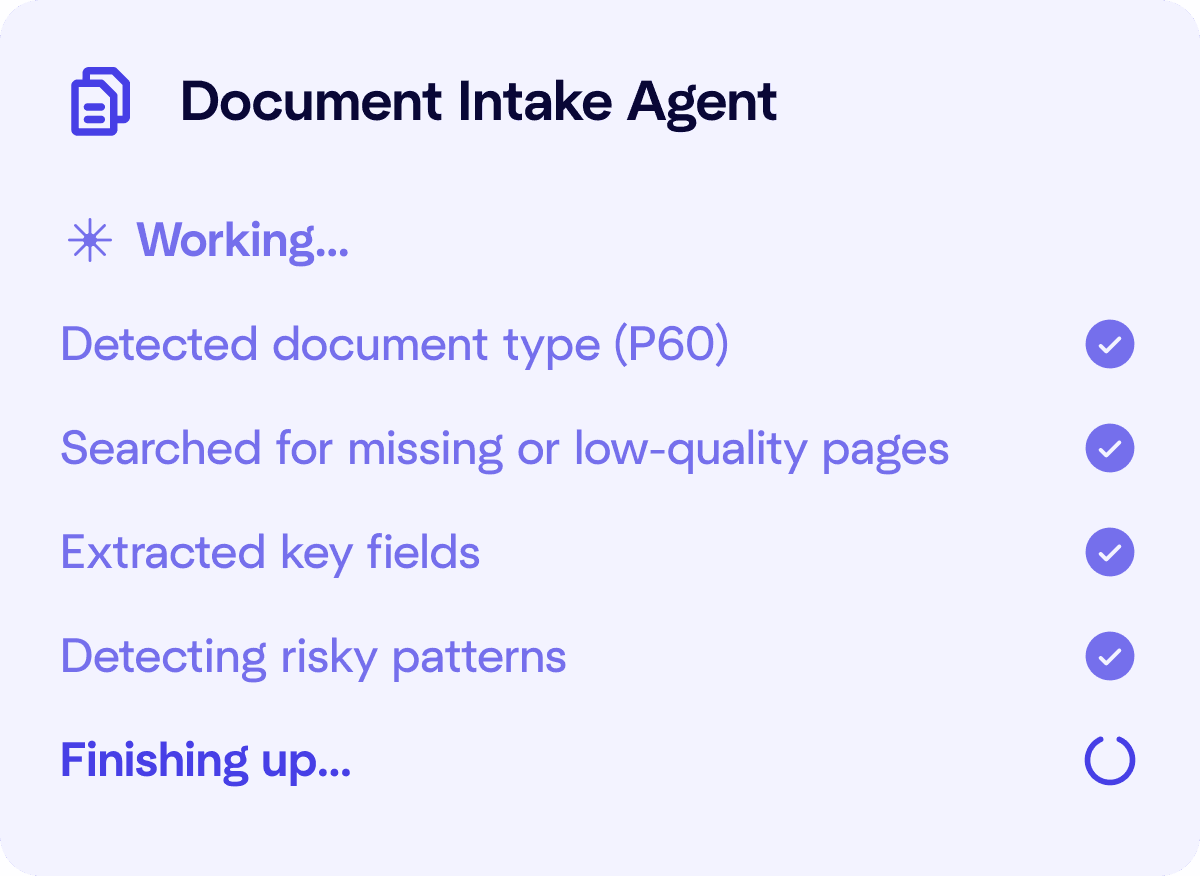

AI that cannot explain its reasoning or show its sources is unusable in a regulated environment. LendWell avoids this by running on a semantic knowledge graph. Every agent works from a shared, typed model of your data, not opaque guesses.

This means the system can cite exactly where any fact came from. Documents, emails, chats, calls, bank data, and reports are all linked to the underlying entities they describe. Audit trails become automatic. Data stays compartmentalised. Compliance teams can trace every decision in one step.

The result is a platform where AI does not invent information because it cannot. It only operates over verified, referenceable data.